How to increase insurance agent productivity – In the ever-competitive world of insurance, agents who consistently exceed productivity targets are the ones who thrive. This guide will provide you with proven strategies to streamline your workflow, enhance customer engagement, leverage data and analytics, pursue continuous education, and integrate technology to skyrocket your productivity and drive success.

Streamlining Workflow Processes

Optimizing workflow processes is crucial for increasing insurance agent productivity. By implementing efficient systems and leveraging technology, agents can streamline their daily tasks, reduce manual labor, and prioritize their time effectively.

Automation and Efficiency

Automating repetitive tasks through software and tools can significantly reduce the time spent on administrative duties. This includes tasks such as data entry, email scheduling, and policy generation. By automating these processes, agents can free up more time to focus on higher-value activities, such as building relationships with clients and generating new leads.

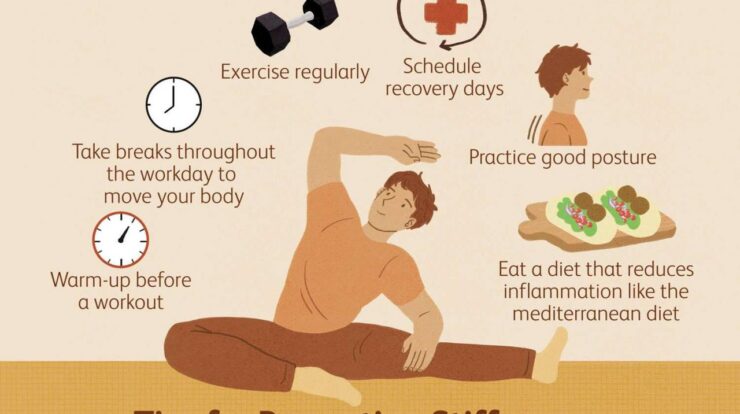

One of the most important things you can do to increase your productivity is to set goals. Once you know what you want to achieve, you can create a plan to help you get there. There are many different ways to increase your productivity, but some of the most effective include setting goals, prioritizing your tasks, and taking breaks throughout the day.

You can also learn more about how to increase your productivity by reading this article: How to Increase Insurance Agent Productivity .

Task Prioritization and Time Management

Effective task prioritization and time management are essential for maximizing productivity. Agents should prioritize tasks based on their importance and urgency, using techniques such as the Eisenhower Matrix or the ABCDE method. Additionally, using a calendar or task management tool can help agents stay organized and on track, ensuring that they complete tasks within the allotted timeframes.

Enhancing Customer Engagement: How To Increase Insurance Agent Productivity

Building strong relationships with clients is essential for increasing insurance agent productivity. By fostering trust and rapport, agents can create a loyal customer base that drives referrals and repeat business.

Effective communication is key to building strong relationships. Agents should be responsive to client inquiries, providing clear and concise information in a timely manner. Personalized service is also important, as it shows clients that they are valued and that their needs are being met.

Utilizing Technology

Technology can be a powerful tool for enhancing customer engagement. By using automated communication tools, agents can stay in touch with clients without spending excessive time on administrative tasks. Social media can also be used to build relationships and provide valuable information to clients.

Leveraging Data and Analytics

Harnessing data and analytics is pivotal in boosting insurance agent productivity. By meticulously collecting and analyzing customer data, agents can uncover valuable insights, identify trends and patterns, and make informed decisions that drive success.

Collecting and Analyzing Customer Data

To leverage data effectively, agents must first establish a robust data collection system. This involves gathering information from various sources, such as customer surveys, CRM systems, and social media platforms. Once collected, data should be meticulously analyzed to extract meaningful insights.

Tailoring Marketing Campaigns and Sales Strategies

Data analytics empowers agents to tailor marketing campaigns and sales strategies with precision. By understanding customer preferences, demographics, and purchasing behaviors, agents can craft targeted messages and offerings that resonate with specific segments. This data-driven approach significantly enhances the effectiveness of marketing efforts and increases conversion rates.

Tracking Key Performance Indicators

Data analytics plays a crucial role in tracking key performance indicators (KPIs) that measure agent productivity. By monitoring metrics such as lead generation, conversion rates, and customer satisfaction, agents can identify areas for improvement and make data-driven adjustments to their strategies.

Continuous Education and Development

In the dynamic insurance industry, continuous education and professional development are crucial for agents to maintain their competitive edge and provide exceptional service. Ongoing training empowers agents with the knowledge, skills, and expertise necessary to navigate evolving industry trends, regulatory changes, and customer expectations.

Resources for Skill Enhancement

Numerous resources are available for agents to enhance their skills, including:

-

-*Professional Development Programs

Industry organizations, such as the National Association of Insurance and Financial Advisors (NAIFA) and The American College of Financial Services, offer comprehensive programs designed to develop agents’ knowledge and skills.

-*Online Courses and Webinars

With so much competition in the insurance industry, it’s more important than ever to find ways to increase productivity. There are a number of things you can do to improve your efficiency, such as using a CRM system to manage your leads and clients, or automating tasks like email marketing.

You can also learn more about how to increase insurance agent productivity by reading articles and blogs on the topic.

Online platforms like Coursera, Udemy, and LinkedIn Learning provide a wide range of courses covering various insurance topics, including underwriting, claims management, and risk assessment.

The insurance industry is a tough one, and it can be hard to stand out from the competition. If you’re looking for ways to increase your productivity, you’re in luck. There are a few things you can do to make yourself more efficient and effective.

Click here to learn more about how to increase insurance agent productivity.

-*Mentorship and Coaching

Experienced agents can provide valuable guidance and support to newer agents, sharing their insights and best practices.

Staying Updated with Industry Trends and Best Practices

To stay abreast of industry trends and best practices, agents should:

-

-*Attend Industry Conferences and Events

Major industry events offer opportunities to network with peers, learn about emerging trends, and gain insights from industry experts.

-*Read Industry Publications

Trade magazines, such as Insurance Business America and National Underwriter, provide valuable information on industry news, regulations, and best practices.

-*Join Professional Organizations

Membership in professional organizations like NAIFA and the Independent Insurance Agents & Brokers of America (IIABA) provides access to exclusive resources, educational events, and industry updates.

Technology Integration

In today’s digital age, technology has become an indispensable tool for insurance agents looking to boost their productivity. By leveraging a range of software solutions, agents can streamline their workflow, enhance customer engagement, and automate repetitive tasks, freeing up valuable time to focus on high-value activities.

CRM Systems

Customer relationship management (CRM) systems serve as a central hub for managing all aspects of customer interactions. They provide a comprehensive view of each customer’s history, preferences, and touchpoints, enabling agents to deliver personalized and tailored experiences. CRM systems also automate lead management, allowing agents to track leads from initial contact through to conversion.

Communication Tools

Technology has transformed communication channels, making it easier for agents to connect with customers in real-time. Email, instant messaging, and video conferencing tools enable agents to respond promptly to inquiries, provide support, and schedule appointments. Integration with CRM systems ensures that all communication is captured and tracked, providing a complete record of customer interactions.

Task Automation

Software tools can automate a wide range of repetitive tasks, such as data entry, appointment scheduling, and policy renewals. This frees up agents to focus on more complex tasks that require human judgment and expertise. Automation also reduces errors and ensures consistency in processes.

Examples of Successful Integrations, How to increase insurance agent productivity

- Progressive Insurance: Progressive has successfully integrated a chatbot into its website, enabling customers to get instant answers to common questions and schedule appointments.

- State Farm: State Farm has implemented a mobile app that allows agents to access customer information, manage policies, and process claims on the go.

- MetLife: MetLife has partnered with Salesforce to enhance its CRM capabilities, providing agents with a 360-degree view of customers and automating lead management processes.

Outcome Summary

By implementing the strategies Artikeld in this guide, you’ll not only boost your productivity but also enhance the customer experience, gain a competitive edge, and unlock your full potential as an insurance agent. Remember, the key to success lies in continuous improvement and embracing innovation.

Stay ahead of the curve, adapt to industry trends, and watch your productivity soar.

FAQ Summary

How can I prioritize tasks effectively?

Use the Eisenhower Matrix to categorize tasks based on urgency and importance. Focus on completing the most urgent and important tasks first.

What are some tips for effective communication with clients?

Be clear, concise, and empathetic in your communication. Use active listening to understand their needs and tailor your responses accordingly.

How can I leverage data analytics to improve sales strategies?

Analyze customer data to identify trends and patterns. Use this information to personalize marketing campaigns, target the right prospects, and optimize your sales pitch.